The Clean Build Method: Starting Your 2026 Budget

Starting My 2026 Budget With a Clean Build (A Gentler Way to Begin)

There’s something about the start of a new year that makes everything feel louder.

New goals. New timelines. New pressure to get it right this time.

When I first started thinking about my 2026 budget, I felt that familiar knot in my chest. Not because I didn't care—but because I cared too much. I had spreadsheets half-finished, notes from past attempts, and a quiet fear that I was already behind before I even started. If you're in the same place, our guide on how to create a monthly budget for 2026 offers a practical starting point without the pressure.

That’s when I stumbled into what I now call my Clean Build mindset.

Not a system.

Not a framework.

Just a gentler way of starting.

And honestly? It surprised me how much relief it brought.

What Is a “Clean Build” Budget?

When I say Clean Build, I don’t mean wiping the slate because the past was “bad.”

I mean starting fresh without dragging emotional baggage from old budgets into a new season.

For me, a Clean Build looked like:

- Not importing last year's categories automatically

- Not assuming my habits had to stay the same (if you're curious about common pitfalls, here are budget mistakes to avoid)

- Not treating past decisions as mistakes that needed correcting

It was less about fixing and more about observing.

If traditional budgeting has ever made you feel tense or behind, this mindset can help you ease back into your finances without pressure.

What I Noticed When I Didn’t Start With Old Numbers

This part caught me off guard.

When I didn’t look at my old budget right away, I noticed how much of it had been built on expectations instead of reality.

Some categories existed because they sounded responsible.

Some were leftovers from a version of me with a totally different life.

Some were quietly making me feel like I was failing every month—even when I wasn’t overspending.

Without those old numbers staring back at me, I could ask softer questions like:

- “What does my life actually look like right now?”

- “What feels heavy lately?”

- “What feels supportive?”

That shift alone made budgeting feel less like a report card and more like a mirror.

(If you’re just getting started, this pairs well with our guide on how to track your spending without guilt.)

3 Questions to Ask During a Clean Build

Instead of starting with percentages or limits, I started with curiosity.

Here are three questions that helped me slow down and reconnect with my spending:

-

Does this expense reflect who I am today?

Not who I was last year. Not who I’m trying to become overnight. -

Does this spending support my energy or quietly drain it?

Some expenses are worth every dollar. Others cost more emotionally than financially. -

If I were choosing this category today, would I add it again?

This question helped me spot habits I was carrying forward out of inertia, not intention.

There are no right answers here. The goal isn’t to decide yet—it’s to notice.

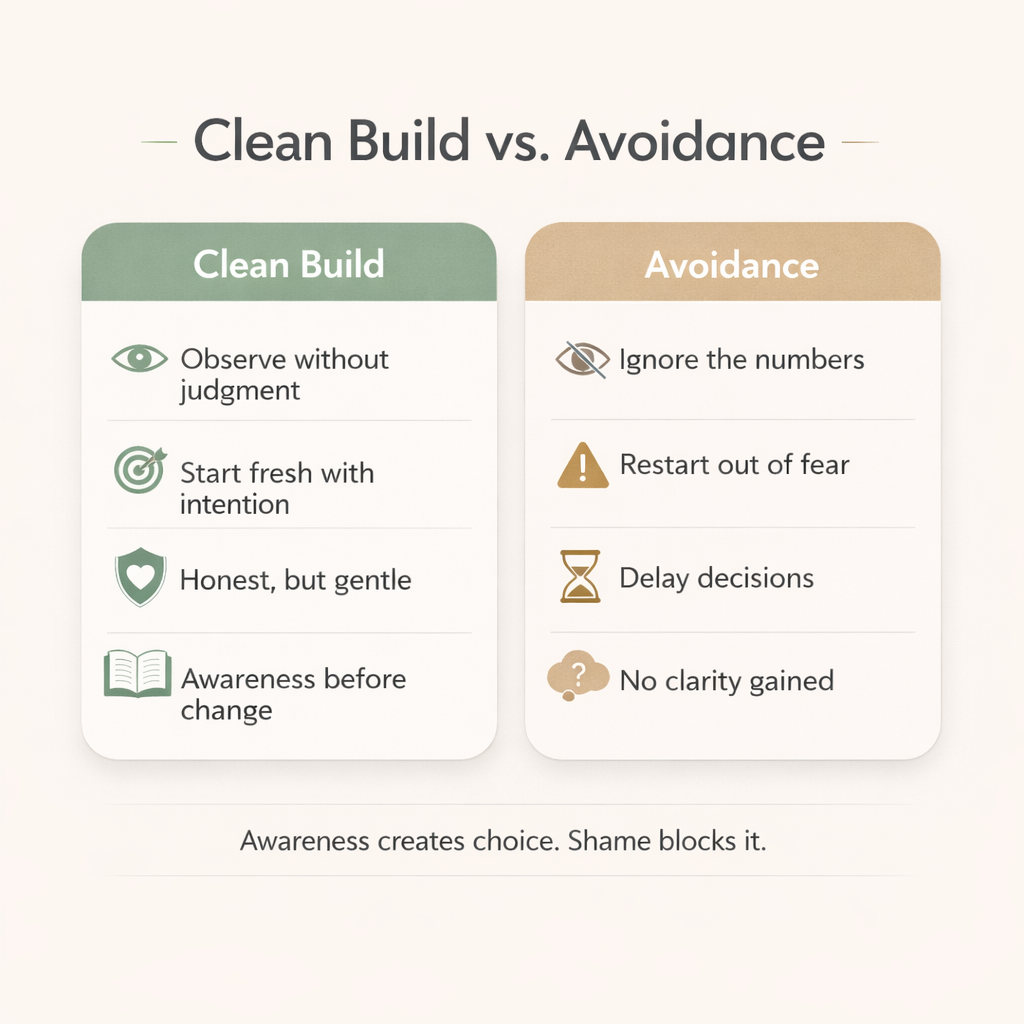

Clean Build vs. Avoidance (An Important Distinction)

A Clean Build is not the same thing as ignoring your finances.

Here’s how I think about the difference:

A Clean Build still involves honesty.

A Clean Build still involves honesty.

It just removes shame from the process.

Avoidance says, “I can’t handle this.”

A Clean Build says, “I’m allowed to look gently.”

Awareness Before Adjustment

One thing I’m learning—slowly—is that understanding comes before changing.

Most budgeting advice jumps straight to:

- Cutting categories

- Setting limits

- Optimizing percentages

Those tools can be useful. But they tend to work better when they’re built on awareness instead of pressure.

For me, awareness looked like:

- Letting patterns show up without labeling them “good” or “bad”

- Noticing where my money supported my energy

- Seeing where it quietly drained me

This idea is also supported by behavioral research. According to the American Psychological Association, emotional awareness plays a key role in how people make financial decisions, and reducing shame can lead to more sustainable money habits.

What Surprised Me Most About Starting Fresh

I expected a new budget to feel motivating.

I didn’t expect it to feel calm.

There was no dramatic “new me” energy.

No strict rules.

No promise that this year would be perfect.

Instead, it felt like saying:

“Okay. This is where I’m starting from.”

And that felt grounding.

If You’re Feeling Behind With Your Budget

If you’re staring at 2026 and thinking:

- “I should be further along”

- “I already messed this up”

- “Everyone else has this figured out”

You’re not alone.

A budget doesn't have to be a correction. It can be a check-in.

Not a judgment.

Not a promise.

Just a snapshot of where you are right now.

Ready to put this into practice? Our Monthly Budget Calculator lets you start fresh without judgment—just awareness and clarity.

Written & Reviewed By

Lynae Thomas

I’m Lynae, the creator of SteadySpend and a software engineer learning personal finance the same way I learn code: by experimenting, making mistakes, and iterating. After navigating my own path through debt and rebuilding my financial foundation, I started sharing what actually worked for me. I’m here to provide the simple tools and judgment-free reflections I wish I’d had when I was first trying to feel calm and capable with my money.

Related Articles

Post-holiday debt can feel heavy, but it doesn’t have to come with guilt. This article focuses on understanding December spending, building financial awareness, and starting 2026 with clarity and self-compassion.

Saving money often feels like a constant race against an invisible finish line. Lynae Thomas explores why she finally stopped chasing the 'perfect' number and shares the guilt-free frameworks she actually uses to stay on track.

Stop feeling overwhelmed by savings. Learn how to build a simple starter emergency fund with small, consistent steps—no complex math required.